Senior Analyst, U.S. Equity Indices

S&P Dow Jones Indices

Chinese investors tend to exhibit high exposures to domestic equities. Incorporating U.S. equities could help Chinese investors diversify their strategies and alleviate home-country bias. For example, the S&P 500® may be relevant for exposure and sensitivity to the U.S. economy. Additionally, market participants seeking to offset domestic equity biases or express tactical views may wish to consider the potential applications of the S&P 500 sector indices.

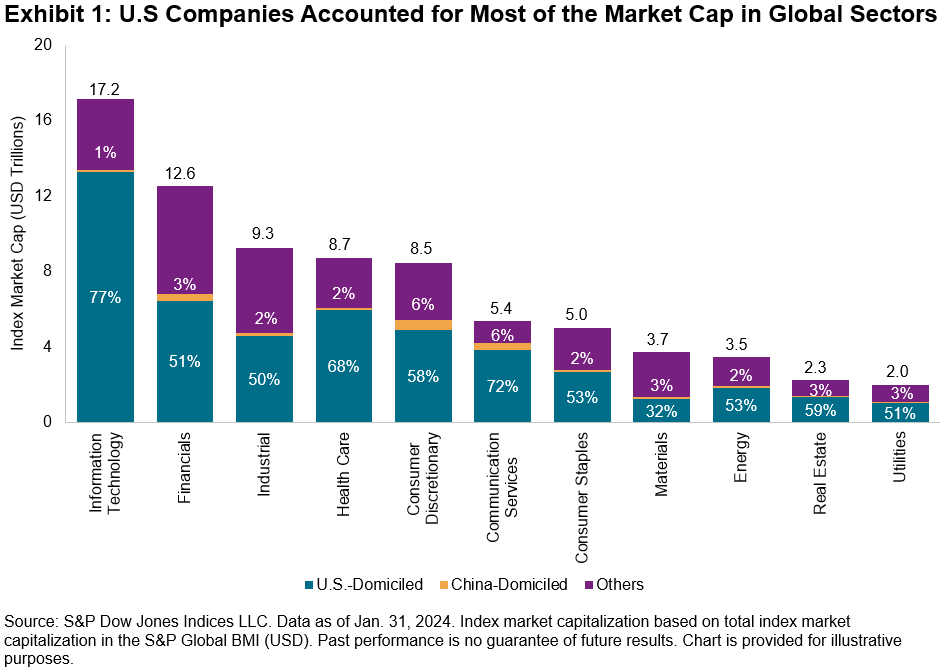

The representation of U.S. equities in global equity markets underscores the importance of a U.S. perspective when looking to express views on various sectors. Exhibit 1 shows the proportion of each GICS® sector represented by companies domiciled in different parts of the world. Specifically, U.S.-domiciled companies accounted for most of the market capitalization in 10 out of the 11 global sectors.

Moreover, the breadth and depth of the U.S. equities market means that the size of S&P 500 sectors is comparable to many countries. For instance, as of Jan. 31, 2024, the market capitalization of the S&P 500 Information Technology (USD 12 trillion) was second only to the entire U.S. market in the S&P Global BMI (USD 50 trillion). The S&P 500 Financials and S&P 500 Health Care are comparable in size to the Japanese market. The size of U.S. sector segments means that expressing views through a sector lens could have presented similar opportunities—as measured by market size or capacity-adjusted dispersion—as expressing views through a country lens, historically…………………

https://www.indexologyblog.com/2024/03/06/u-s-sector-relevance-to-china